The Corporate Transparency Act: What Startups Need to Know About Compliance

This bulletin is intended for general informational purposes only and is not intended as legal advice on any matter. Do not act or refrain from acting on the basis of any of the content in this bulletin. This bulletin is current only as of December 4, 2023 and will not be updated for any changes in law occurring after such date.

On September 30, 2022, the Department of Treasury’s Financial Crimes Enforcement Network (“FinCEN”) published the final rule regarding Beneficial Ownership Information Reporting Requirements (the “Final Rule”) pursuant to the Corporate Transparency Act (“CTA”), and on November 30, 2023, FinCEN published certain amendments to the Final Rule. Congress enacted the CTA as part of the Anti-Money Laundering Act of 2020 to reduce the prevalence of foreign and bad actors hiding their identities in shell companies formed in the United States, and to bring the United States in line with international beneficial ownership reporting standards. The CTA is a federal statute; therefore, companies formed or registered in any state are subject to the CTA’s requirements.

The Final Rule requires certain companies to file with FinCEN a report containing certain information about the company as well as any of its “beneficial owners” and, in some cases, “company applicants”. Although the rule does not go into effect until January 1, 2024, the Innovation Clinic highly recommends that companies begin gathering relevant information now so they can be prepared to comply, and that prospective founders keep the Final Rule in mind when conducting the entity formation process for their startups. This client alert outlines the Final Rule’s requirements and consequences of noncompliance.

Who Must Comply with the Final Rule?

The Final Rule applies broadly to domestic and foreign “reporting companies.” A “domestic reporting company” is any corporation, LLC, or other entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe. A “foreign reporting company” is any corporation, LLC, or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office. Most startups incorporated in any state within the United States will be considered domestic reporting companies.

The Final Rule exempts 23 categories of companies from the definition of a reporting company. These exemptions include SEC reporting issuers, banks and credit unions, tax-exempt entities, money services businesses registered with FinCEN, broker-dealers, investment companies and investment advisors, venture capital fund advisors, and certain large operating companies, among others. Most startups will not meet the requirements for one of the enumerated exemptions and will thus be required to comply with the Final Rule.

Whose Information Must be Reported to FinCEN?

The Final Rule requires reporting companies to report information concerning themselves and all of their “beneficial owners” and “company applicants.”

Beneficial Owners

A beneficial owner is any individual who, directly or indirectly, (1) exercises “substantial control” over the reporting company or (2) owns or controls at least 25% of the ownership interests of the reporting company.

An individual is deemed to have “substantial control” over the reporting company if they, directly or indirectly, via board representation, ownership or control of a majority of voting rights, contract or agreement (including in connection with any financing arrangement), or any other mechanism, including through any intermediary entities that separately or collectively have such substantial control:

- Hold a senior officer position within the company, including president, CEO, CFO, COO, GC, or anyone who performs similar functions regardless of title;

- Can appoint or remove any senior officer or a majority of the board of directors or any similar body of the entity;

- Direct or influence important decisions of the company; or

- Have any other substantial control over the company.

To determine whether an individual controls at least 25 percent of the ownership interests of the reporting company, the individual’s total ownership interests are compared to all outstanding ownership interests of the company. Ownership interests include all equity securities, convertible interests, profits and capital interests, options, and any other contracts, arrangements or understandings. Further, an individual is treated as having ownership over any such interest if they have an undivided joint ownership of the equity interest, if they own the interest through another individual or entity acting as an intermediary or custodian, or if the person is the sole beneficiary of, a trustee with the authority to dispose of assets of, or a grantor or settlor who has the right to revoke or otherwise withdraw the assets of, a trust that holds the ownership interest. When calculating ownership interests for each individual or entity on the cap table, all options and similar interests are considered to be exercised and added to the individual’s or entity’s equity ownership.

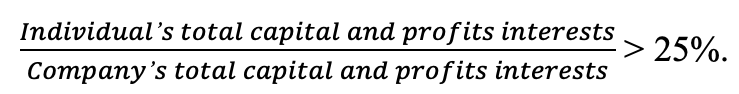

For entities taxed as partnerships, an individual is a beneficial owner if:

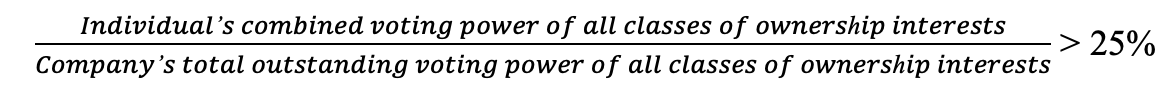

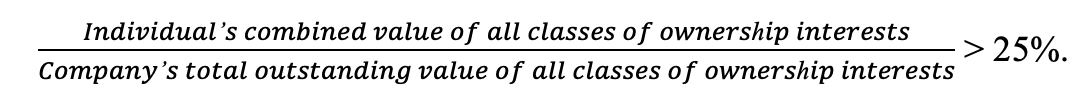

For entities taxed as corporations, an individual is a beneficial owner if:

or

Importantly, it may be difficult or impossible for many startups that have instruments such as Simple Agreements for Future Equity (“SAFEs”) or convertible notes outstanding to determine what the total outstanding voting power or total outstanding value of all classes of ownership interests is, or the voting power or value of the equity issued pursuant to a particular SAFE or convertible note, prior to the date when such instruments convert. These instruments may require the issuer to know the valuation that will be assigned to the issuer in its next priced round of fundraising as well as the amount of new money that the investors in the priced round will invest to determine such numbers with certainty, yet the Final Rule requires Safeholders and convertible noteholders to be included in beneficial ownership calculations for all owners and, if they meet the thresholds above, to be disclosed as described below. The Final Rule states that in such cases where the facts and circumstances do not permit the calculations of 25% ownership to be performed with reasonable certainty, then such calculations should be made by class of equity or type of ownership, and any person who owns or controls 25% or more of any class of equity or type of ownership should be disclosed as a beneficial owner. For example, a startup that has only common stock and SAFEs outstanding would report to FinCEN any person who is a beneficial owner of 25% of the common stock as a class, as well as any person whose investment represents 25% of the outstanding purchase amounts under all SAFEs.

The Final Rule exempts five categories of individuals from the definition of beneficial owner, meaning the reporting company need not report any information about the following individuals who would otherwise be considered beneficial owners:

- Minors (so long as the relevant information of a parent or legal guardian is reported);

- An individual acting as a nominee, intermediary, custodian, or agent for others;

- Non-officer employees whose equity interests in the issuer are only derived from their employment;

- Individuals whose interest in the issuer is solely a future interest through a right of inheritance; and

- Creditors.

When calculating whether an individual is a beneficial owner, FinCEN suggests erring on the side of caution. If it is unclear whether or not an individual is a beneficial owner, it is likely better to overreport than to underreport. Misrepresenting the beneficial ownership of your company could lead to significant consequences (outlined below).

Company Applicants

A company applicant (with respect to a domestic reporting company) is (1) any individual who directly files the document that creates or registers the company and (2) the individual who is primarily responsible for directing or controlling the filing if more than one individual is involved in the filing of the document. Reporting companies may report one or more company applicants. Only companies created or registered after January 1, 2024, must report information for company applicants.

Taking the definition of beneficial ownership and a company applicant collectively, most startups will likely need to report the relevant information for the following individuals:

- The founding team;

- C-suite executives;

- Any advisors or members of the board with significant formal or informal influence;

- Any large individual or institutional investors; and

- The individual who filed the incorporation documents for the company, including an attorney or registered agent who performed the filing, or any member of the startup team who was involved in filing the document.

What Information Must be Reported to FinCEN?

A reporting company must report and certify the accuracy and completeness of the following information about itself and each of its beneficial owners and, for companies formed after January 1, 2024, company applicants, on an initial report.

Reporting Company

A reporting company must provide the following information about the company:

- The full legal name of the company;

- Any trade names or “doing business as” (d/b/a) names of the company;

- The complete address of the company’s principal place of business if it is within the United States, or, if the company’s principal place of business in not within the United States, the complete address in the United States where the reporting company does business;

- The jurisdiction of formation of the company;

- For a foreign reporting company, the State or Tribal jurisdiction where the company first registers; and

- The Internal Revenue Service Taxpayer Identification Number (“TIN”) and/or Employer Identification Number (“EIN”) of the company, or, for a foreign reporting company that does not have a TIN, a tax identification number issued by a foreign jurisdiction as well as the name of the jurisdiction.

Beneficial Owners for All Companies & Company Applicants for Companies Created or Registered After January 1, 2024

A reporting company must provide the following information about each beneficial owner and, if the company is created or registered after January 1, 2024, each company applicant (companies formed prior to January 1, 2024 do not need to disclose information about company applicants):

- The full legal name of the individual;

- The date of birth of the individual;

- The residential street address of the individual or, for a company applicant who forms or registers an entity in the course of such company applicant’s business, the street address of such business;

- A unique identifying number from a non-expired United States passport, a non-expired state, local, or tribal-issued identification document, or a non-expired driver’s license issued by a U.S. state, or, if the relevant person has none of the foregoing, a non-expired non-U.S. passport (if the individual does not possess any of the other documents just described); and

- An image of the document from which the unique identifying number was obtained.

FinCEN Identifiers

Any individual or reporting company may apply for a “FinCEN identifier” number by submitting an application containing substantially the information otherwise required to be reported by such person outlined above. Once the identifier is issued, a reporting company may report the identifier of such person or company on its reports under the CTA, instead of all of the information listed above. Reporting companies applying for an identifier must first submit to FinCEN an initial report and then submit an identifier application. Individuals and reporting companies with identifiers must update and correct information submitted to FinCEN related to such identifier when necessary to keep FinCEN’s records current and complete in order to continue using the identifier.

When Must Companies Report to FinCEN?

The Final Rule becomes effective on January 1, 2024. Reporting companies created or registered before January 1, 2024 must submit an initial report by January 1, 2025. Reporting companies created or registered on or after January 1, 2024 but before January 1, 2025 must submit an initial report within 90 days of receiving actual notice of their creation or registration (which includes the company showing up has having been formed on a search of the database of companies in the relevant jurisdiction, if applicable). Entities formed on or after January 1, 2025 must submit an initial report within 30 days of receiving actual notice of their creation or registration (which includes the company showing up as having been formed on a search of the database of companies in the relevant jurisdiction, if available).

The Final Rule also requires reporting companies to submit an updated report within 30 days when there is any change in the reporting company’s or its beneficial owners’ or company applicants’ information previously reported to FinCEN. For example, a reporting company must submit an updated report if:

- The company’s name or principal place of business changes;

- A beneficial owner’s or company applicant’s name or residence changes; or

- The company has new beneficial owners.

If a reporting company discovers any inaccurate information in a previously submitted report, it must correct such information within 30 days after discovering the inaccuracy.

What are the Violations for Noncompliance?

Willful violations of the Final Rule may result in civil penalties of up to $500 per day if a violation is not remedied and criminal penalties of up to $10,000 per day and/or imprisonment for up to two years. Liability can be for direct or indirect violations, for acts or omissions, or even for ignorance in certain situations.

Next Steps

FinCEN has yet to release the required forms to make initial and updated reports, but has confirmed that all reports must be submitted electronically via a portal that FinCEN is currently developing and will launch on January 1, 2024.

The Innovation Clinic is not currently providing support with respect to making these filings with FinCEN, and is providing this alert to you as a courtesy only to make you aware of your obligations under the CTA. We may begin offering this support at a later time, and you are welcome to reach out if you are interested in obtaining our support. We will address those requests on a case-by-case basis. However, as our bandwidth is limited and there is never a guarantee that we will be able to take any matter, please engage with another lawyer as soon as possible to prepare materials for disclosure if desired.

More information on the CTA and compliance can be found in FinCEN’s small entity compliance guide here.